Topic 4: Balance of Payment

Bab J: Balance of Payments

Bab J: Balance of Payments

J1.1 Structure of the Balance of Payments

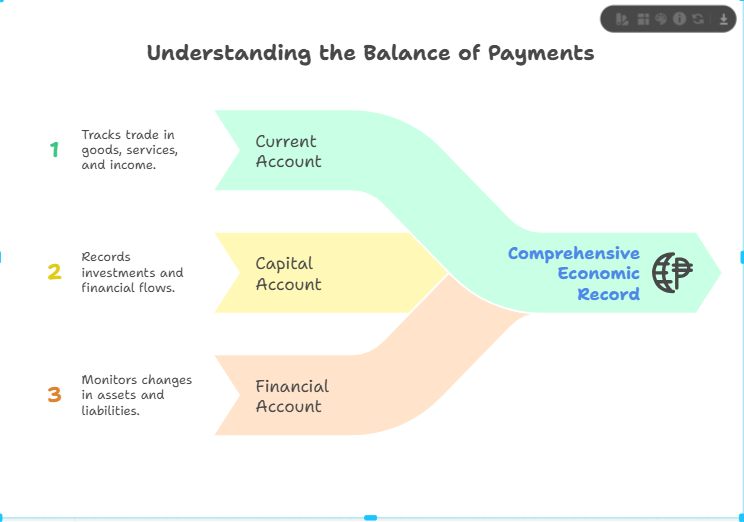

The Balance of Payments (BOP) is a comprehensive record of a country’s economic transactions with the rest of the world over a specific period, typically a year. It is divided into three main accounts: the current account, the capital account, and the financial account. Each component provides critical information regarding the nation’s international economic position.

J1.2 Current Account vs. Capital Account

The current account records the trade in goods and services, primary income (such as dividends and interest), and secondary income (such as remittances and foreign aid). In contrast, the capital account reflects capital transfers and acquisitions or disposals of non-produced, non-financial assets, while the financial account documents investments in financial assets and liabilities, including direct investment, portfolio investment, and reserve assets. Each account plays a distinct role in understanding a country’s external balance.

J1.3 Causes and Consequences of Imbalances

Imbalances in the balance of payments occur when receipts and payments do not match, resulting in either a surplus or a deficit. Persistent deficits may indicate underlying economic issues such as excessive imports, borrowing from abroad, or declining competitiveness. Conversely, sustained surpluses can signal strong export performance but potentially lead to friction with trading partners. Imbalances can affect currency value, reserves, and overall economic stability.

J1.4 How Countries Correct Imbalances

To address persistent BOP imbalances, governments may implement policies such as currency devaluation, trade restrictions, or negotiating foreign loans. Structural adjustments, such as improving competitiveness or fiscal discipline, are often recommended for long-term balance. International organisations, such as the International Monetary Fund (IMF), may also provide financial support and policy guidance to countries facing severe imbalances.