About This Course

Macroeconomic Fundamentals for Exam Excellence

Unlock the Secrets to Scoring High in Macroeconomics!

Are you a student struggling with complex macroeconomic theories?

Do you want to master the fundamentals of macroeconomics and excel in your exams?

This course is designed specially for you!

Why Choose This Course?

- Comprehensive coverage on core macroeconomic topics such as Fiscal Policy, International Trade, Balance of Payments, Exchange Rates, and more.

- Interactive quizzes to reinforce your understanding and help you apply knowledge effectively.

- Content curated by Pn. Rohaizad Binti Wok, an experienced macroeconomics educator with a passion for current economic issues.

- Step-by-step guides, real-world examples, and clear explanations to make learning enjoyable and effective.

- Suitable for university students, teachers, and anyone keen to understand the nation's or global economy.

What Will You Learn?

- Gain mastery over the scope and fundamentals of macroeconomics.

- Develop analytical skills to interpret economic trends and data.

- Prepare confidently for university and professional exams with targeted quizzes.

- Understand the impact of government policies and global economic changes.

Who Is This Course For?

- University and pre-university students taking macroeconomics.

- Teachers and lecturers seeking effective teaching resources.

- Exam candidates and economic enthusiasts.

ROHAIZAD BINTI WOK

Curriculum Overview

This course includes 1 modules, 5 lessons, and 1:33 hours of materials.

Summary: Balance of Payments (BOP)

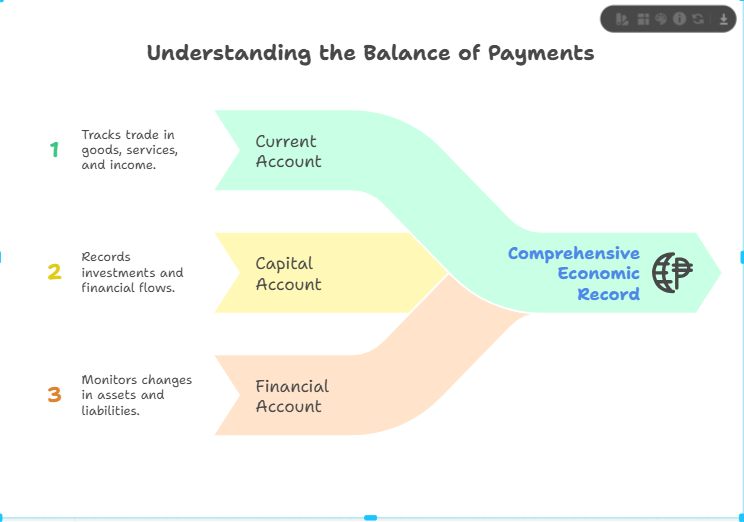

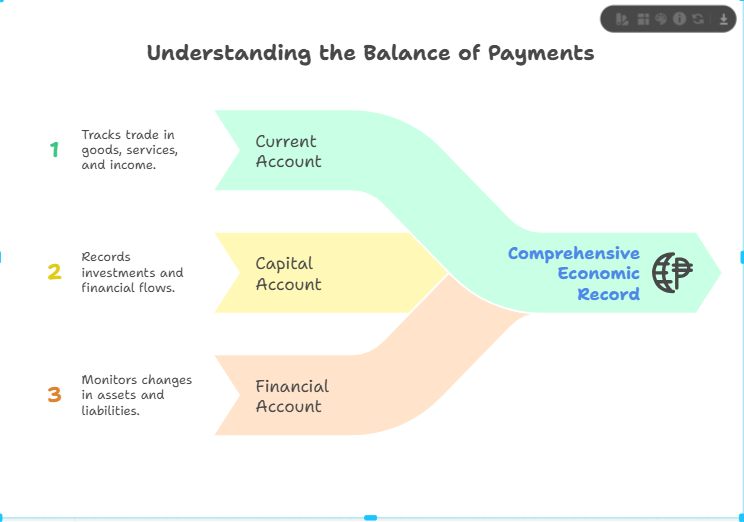

The Balance of Payments (BOP) is a comprehensive record of all economic transactions between a country and the rest of the world. It is structured into three main accounts: the current account (which covers trade in goods and services, income, and transfers), the capital account (which details capital transfers and non-produced asset transactions), and the financial account (which records investments and international financial flows). Each component serves to illustrate the country's economic interactions and financial position globally.

A surplus or deficit in any of these accounts indicates imbalances that could affect currency stability, foreign reserves, and overall economic health. Understanding the balance of payments is crucial for policymakers in designing strategies to address economic challenges and maintain stability. Effective management of BOP imbalances often involves policy interventions such as exchange rate adjustments or trade policy reforms.

In summary, the Balance of Payments is an essential tool to assess a nation’s economic relationships, financial health, and its position in the global economy.

Jika Pn. Rohaizad perlukan summary untuk topik lain atau ingin kembangkan topik lain, boleh maklumkan saja!

1.1 Teori Perdagangan Antarabangsa

Teori Kelebihan Mutlak (Adam Smith): Negara patut tumpu pada barang yang boleh dihasilkan lebih cekap berbanding negara lain.

Teori Kelebihan Bandingan (David Ricardo): Negara patut tumpu kepada barangan yang mempunyai kos peluang yang lebih rendah.

Kedua-dua teori menjelaskan mengapa negara berdagang antara satu sama lain.

1.2 Kebaikan dan Kos Perdagangan

Kebaikan: Akses kepada pelbagai barangan, tingkatkan persaingan, efisiensi, dan pertumbuhan ekonomi.

Kos: Industri tempatan mungkin tidak mampu bersaing, menyebabkan kehilangan pekerjaan dan ketergantungan kepada pasaran luar.

1.3 Halangan Perdagangan dan Proteksionisme

Halangan: Tarif, kuota, larangan import.

Tujuan: Lindungi industri tempatan.

Kesan Negatif: Kurangkan inovasi dan kebajikan ekonomi dalam jangka panjang.

1.4 Perjanjian Perdagangan Bebas

Contoh: AFTA, NAFTA.

Matlamat: Kurangkan halangan perdagangan, galakkan pelaburan, dan jalin hubungan ekonomi lebih erat antara negara-negara ahli.

Nota untuk pelajar: Perdagangan antarabangsa bukan sahaja memberi peluang kepada negara untuk saling melengkapi antara satu sama lain, tetapi juga menekankan pentingnya membuat keputusan ekonomi yang bijak berdasarkan kekuatan masing-masing.

Topik ini membincangkan konsep wang sebagai alat pertukaran yang diterima umum serta ciri-ciri pentingnya seperti boleh diterima, tahan lama, mudah dibahagi dan dibawa, serta terhad dan seragam. Wang berfungsi sebagai medium pertukaran, penyimpan nilai, unit pengiraan dan pembayaran tertunda. Mengikut teori Keynes, permintaan wang dipacu oleh tiga motif: transaksi, berjaga-jaga dan spekulatif. Penawaran wang pula diklasifikasikan sebagai M1, M2 dan M3 mengikut tahap kecairan. Sistem kewangan Malaysia terdiri daripada institusi perbankan dan bukan perbankan, dengan Bank Negara Malaysia sebagai bank pusat yang menjalankan dasar monetari melalui pelbagai instrumen untuk kestabilan ekonomi. Bank perdagangan pula berfungsi menerima deposit, memberi pinjaman, menawarkan perkhidmatan kewangan dan mencipta kredit. Perbankan Islam pula menawarkan produk patuh Syariah seperti Al-Wadiah, Al-Mudharabah, Al-Bai’ Bithaman Ajil, Al-Musyarakah dan Al-Ijarah.

Course Specifications

Send Course as Gift

Reply to Comment